Central Alberta residential MLS sales were up 30% in March compared to February , but down by 10% compared to March 2024. The active listing count on April 1, 2024 was up 19% compared to March 1, 2024, but down 4% compared to April 1, 2024. We are still experiencing a seller’s market in most central Alberta markets, although we are seeing a few more listings come on the market and a slight move toward balance, probably due to the uncertainty buyers are feeling over US tariffs.

On April 2 the US announced tariffs on most of the world’s companies, it not all. Canada escaped the worst case scenario, but is still subject to some tariffs on steel, aluminum and cars. Unfortunately, no one knows whether the situation will get better or worse and that uncertainty will be more damaging than knowing. If we know what we are dealing with, we can get on with it, but if we are uncertain, we hesitate.

ATB Financial stated “We’re now far less concerned about direct impacts of tariffs on Canada and Alberta ….. unfortunately, there is a ‘but’ to all this: the economic benefits of the lighter touch on tariffs for Canada is now being countered by the indirect effects via weaker global economic conditions. The trade war has gone global, and markets have not reacted favourably…… Meanwhile, businesses and consumers will continue to face higher costs from Canadian counter-tariffs, which remain in place with new ones added for autos yesterday. The silver lining remains the same this week as it was last week: there is an urgency to do more here in Canada - building transportation infrastructure, accessing new markets, and tearing down provincial trade barriers. If the trade war spurs this on, this could have a lasting benefit.

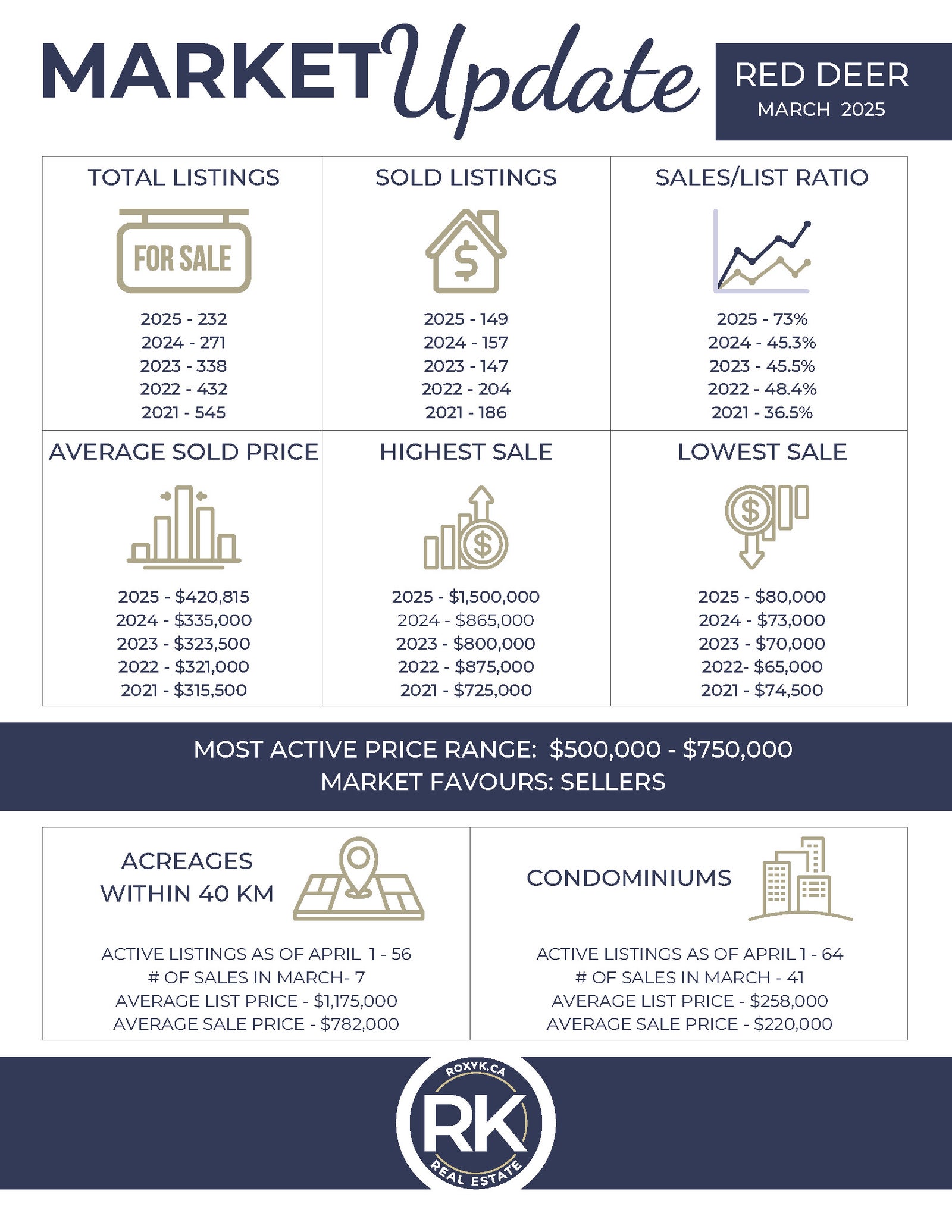

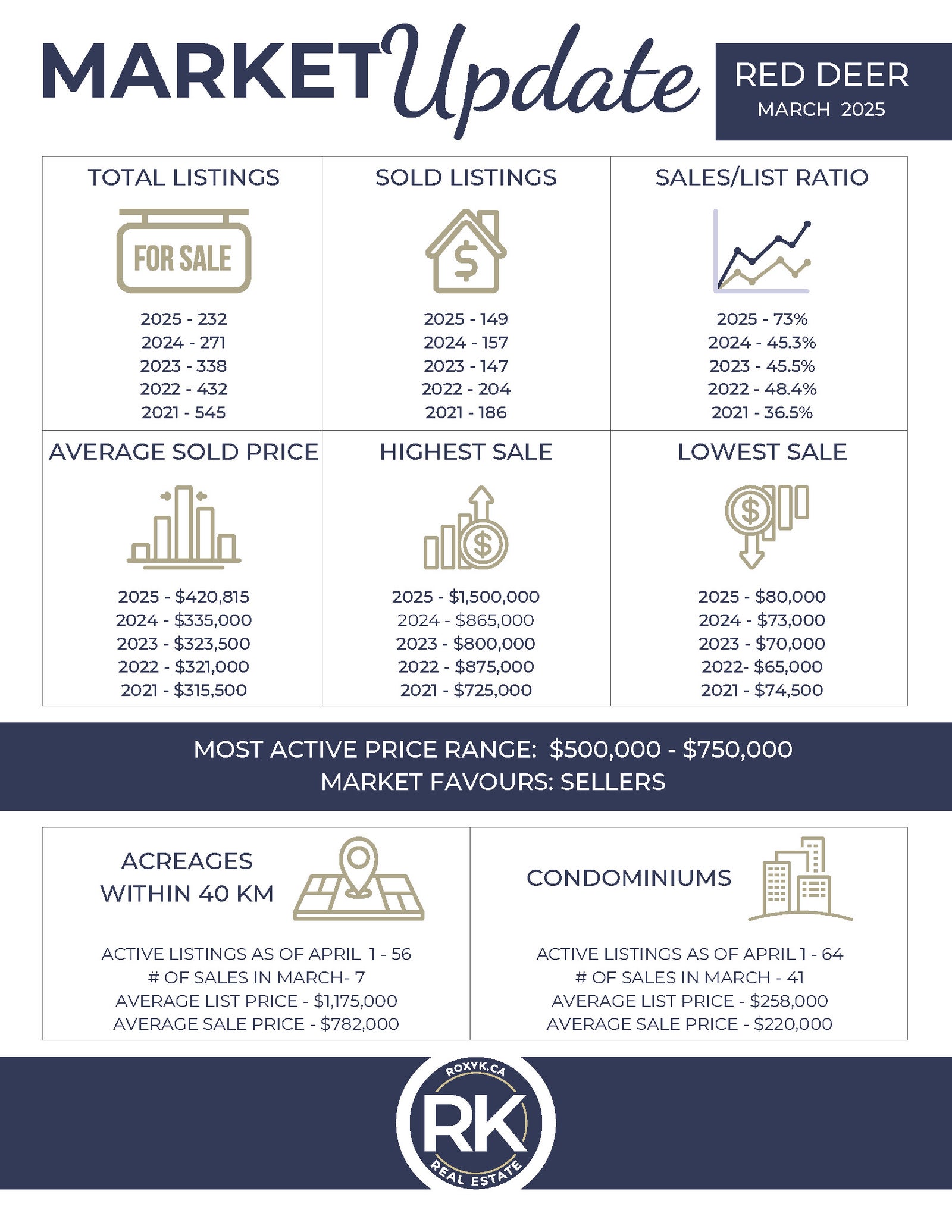

RED DEERTo find out more click the link below

LACOMBE

To find out more click the link below

To find out more click the link below

SYLVAN LAKE

To find out more click the link below

PENHOLD

To find out more click the link below

Central Alberta residential MLS sales were up 30% in March compared to February , but down by 10% compared to March 2024. The active listing count on April 1, 2024 was up 19% compared to March 1, 2024, but down 4% compared to April 1, 2024. We are still experiencing a seller’s market in most central Alberta markets, although we are seeing a few more listings come on the market and a slight move toward balance, probably due to the uncertainty buyers are feeling over US tariffs.

Central Alberta residential MLS sales were up 30% in March compared to February , but down by 10% compared to March 2024. The active listing count on April 1, 2024 was up 19% compared to March 1, 2024, but down 4% compared to April 1, 2024. We are still experiencing a seller’s market in most central Alberta markets, although we are seeing a few more listings come on the market and a slight move toward balance, probably due to the uncertainty buyers are feeling over US tariffs.